Berggruen Institute Teams up with Employ America to Advocate the Federal Reserve Purchase Municipal Bonds

Source: Bureau of Economic Analysis (BEA)

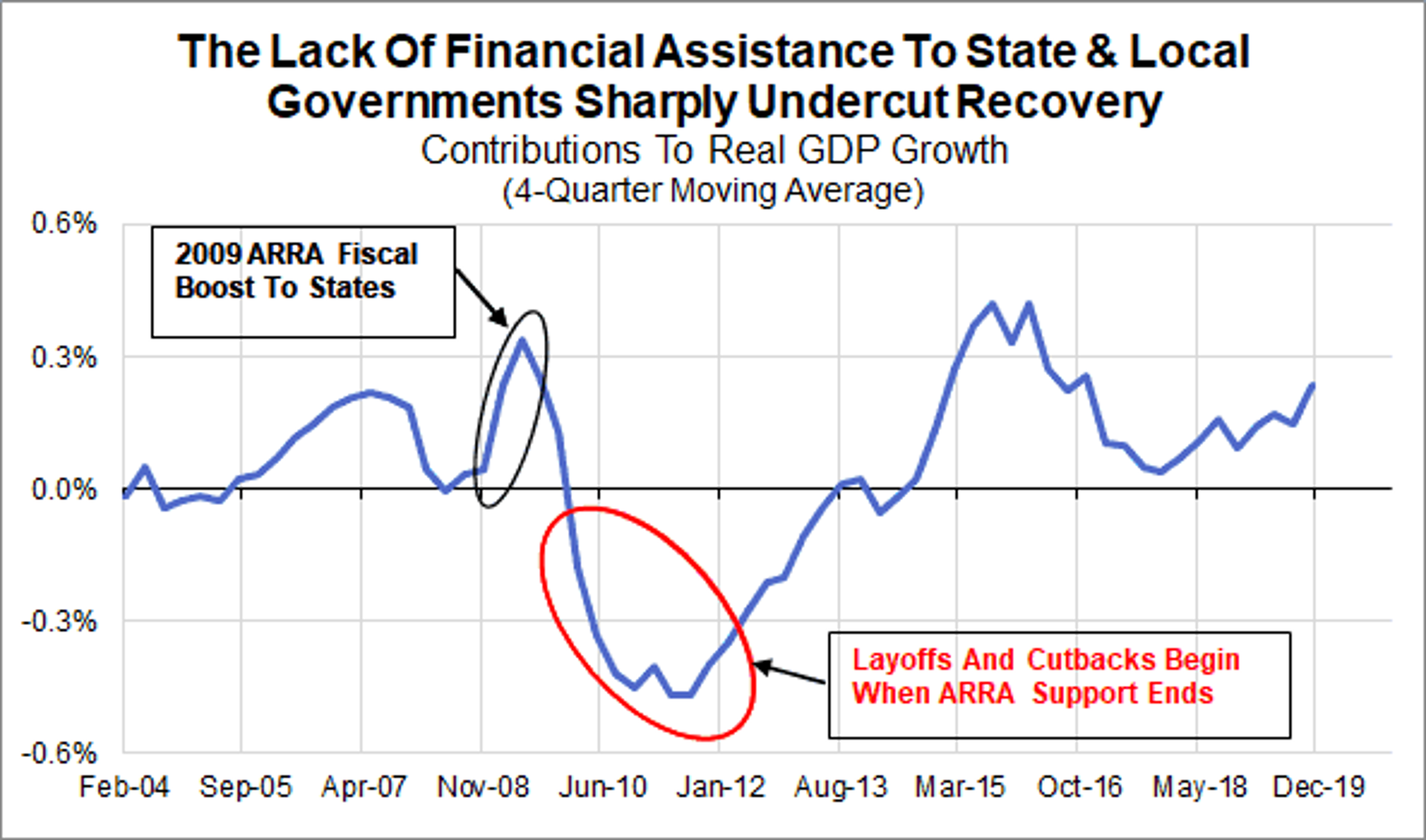

The COVID-19 crisis has triggered an economic crisis that may see unemployment fall as high as during the great depression. In this situation, countercyclical spending is vital to lessen the blow of this crisis and to build the critical infrastructure necessary to fight the pandemic. For the Federal Government, spending is funded via the most liquid market in the world that is backstopped by the Federal Reserve. Unfortunately, states and municipalities, who are on the frontline, do not enjoy such an advantage. In a recession, tax revenue falls and state budgets collapse. The market for the municipal bond markets are extremely thin and volatile and thus the cost of funding for states rises. The Berggruen Institute has teamed up with Employ America to advocate that the Federal Reserve purchase municipal bonds to support states in this recession.

Since our proposal has been issued, the CARE act has included language that expands the authority of the Federal Reserve in this area but it does not yet mandate action. At the moment, municipal markets will be fighting for a variety of other interest group for Fed support. Therefore, the institute will continue to work in this area to both help raise awareness of this critical flaw in economic governance and to help bring together a coalition that will assist in making sure that whatever program that results is targeted to the needs of local leaders and can serve as a model for future innovations in monetary policy.

To read the in-depth article, “The Fed Can and Should Support State Government Efforts to Respond to COVID-19 Right Now,” written by Yakov Feygin and Skanda Amarnath, please click here.